Buying medication from overseas used to be simple. For years, Americans could order pills, creams, or supplies from Canada, India, or Europe through the mail - and pay little to no extra fees. But that changed on August 29, 2025. The U.S. government ended the $800 duty-free threshold for all international packages. Now, even a $25 bottle of blood pressure pills from Germany can trigger a $80 customs fee. If you’re trying to save money on prescriptions, this new rule makes things harder - but not impossible. You just need to know how to play by the new rules.

What Changed in August 2025?

Before August 2025, any package under $800 entered the U.S. without taxes or duties. That meant people could order generic insulin from Canada, antibiotics from India, or thyroid meds from the UK for a fraction of the U.S. price. Over 97% of international mail-order packages qualified for this exemption. But now, only gifts under $100 are still free. Everything else - even if it’s just $15 worth of vitamins - gets taxed. The new system gives carriers two ways to collect duties until February 28, 2026:- Method 1: Calculate duty based on the item’s actual value and its tariff rate (called ad valorem). This is more accurate but requires detailed paperwork.

- Method 2: Flat fees: $80 for low-tariff countries, $160 for medium, $200 for high-tariff ones. This is simpler but can cost way more than the actual value of the medication.

Can You Even Legally Order Medication by Mail?

Yes - but only under strict conditions. The FDA allows personal importation of unapproved drugs if:- The medication is for a serious condition with no U.S. treatment available

- The drug is not for resale

- You’re importing no more than a 3-month supply

- You have a doctor’s note or prescription (even if foreign)

Where to Buy Medication Overseas (And Where Not To)

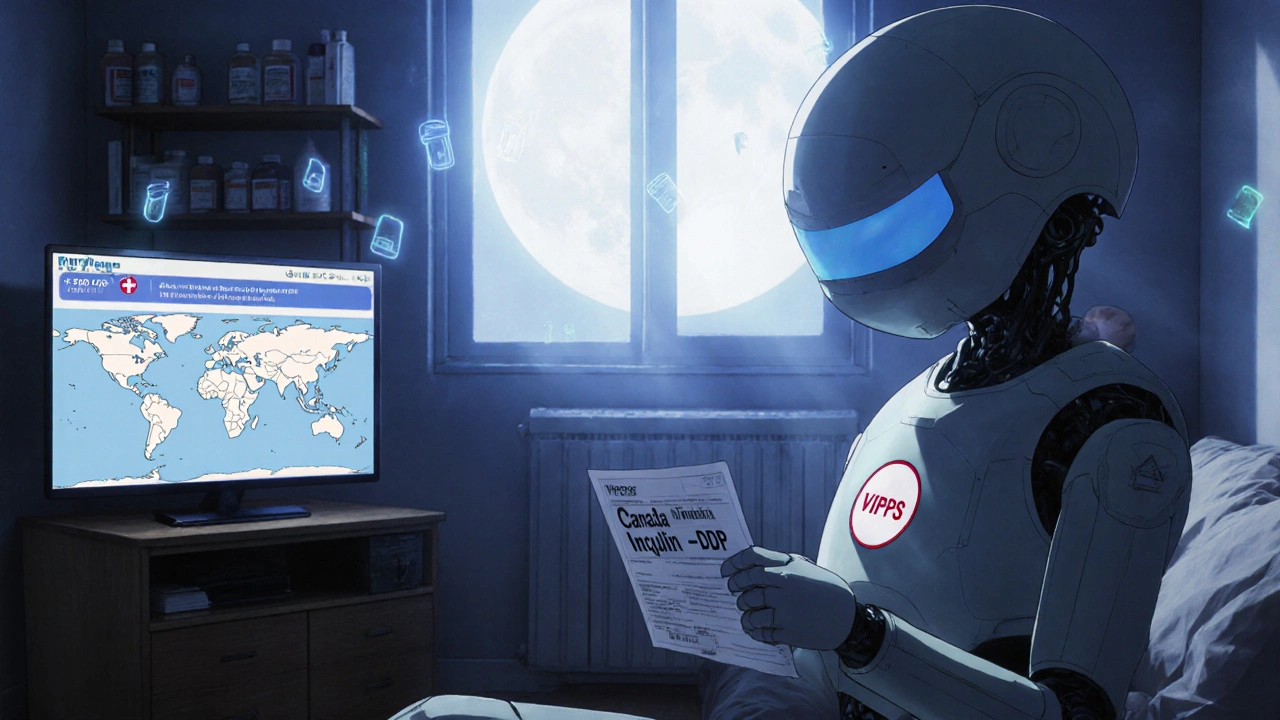

Not all international pharmacies are safe. The National Association of Boards of Pharmacy (NABP) has a list of verified online pharmacies. Look for the VIPPS seal - it means they’re licensed and follow U.S. standards. Avoid sites that:- Don’t require a prescription

- Sell “miracle cures” or unapproved drugs

- Only accept cryptocurrency

- Have no physical address or phone number

- Canada: Licensed, regulated, and often sell U.S.-made drugs at lower prices.

- India: Major generic drug manufacturer. Many U.S. pharmacies source from here. Buy only from licensed Indian pharmacies like Apollo or MedPlus.

- United Kingdom: NHS-approved pharmacies sell branded and generic meds at fixed prices.

- Mexico: Popular for Americans near the border. Many border towns have pharmacies that ship.

How to Avoid Customs Seizures and Fines

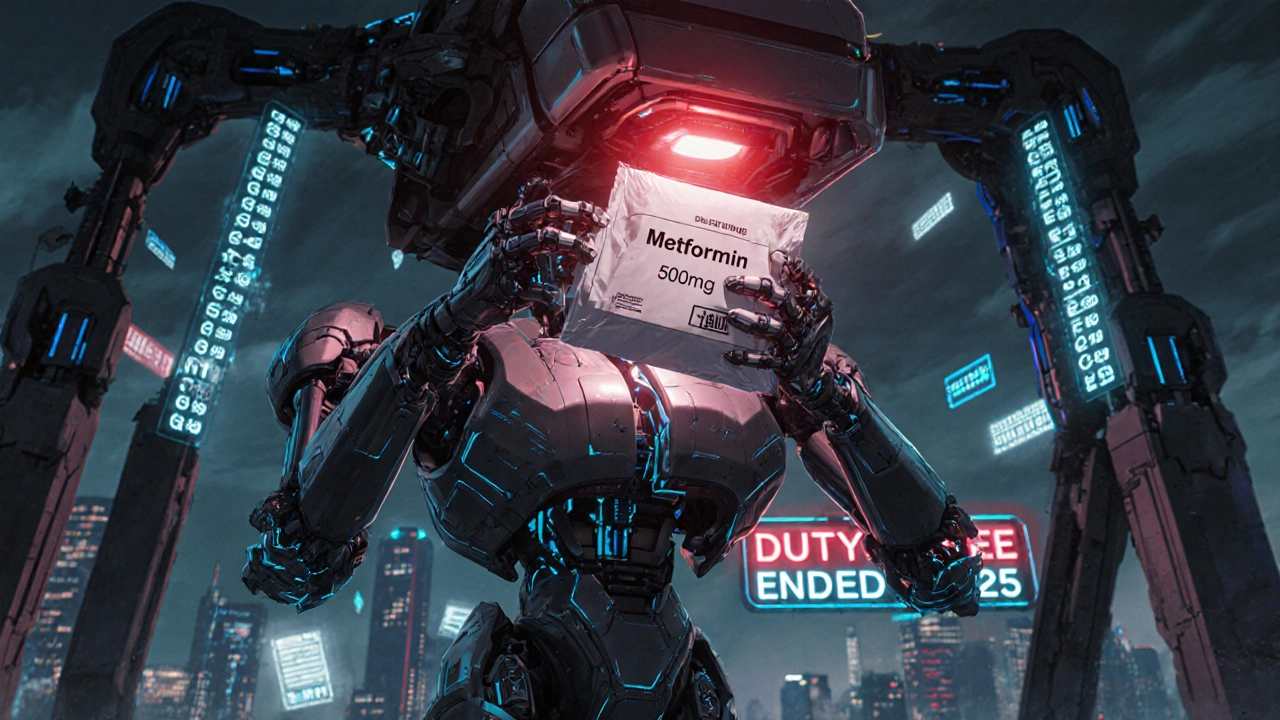

Your package can get stuck, destroyed, or fined if you mess up the paperwork. Here’s how to avoid it:- Use a commercial invoice - not a gift label. Write the exact drug name (e.g., “Metformin Hydrochloride 500mg tablets”), quantity, value, and manufacturer.

- Include the HS code - for most oral medications, it’s 3004.90. Find yours at the USITC website.

- Declare the true value - don’t say “$10” for a $150 bottle. Customs can check the seller’s website. Under-declaring risks seizure.

- Use a bonded carrier - DHL, FedEx, or UPS handle customs for you. USPS and Canada Post now refuse commercial shipments to the U.S.

- Keep a copy of your prescription - even if it’s from another country. Attach it to the package.

Who Pays the Duty? You, the Seller, or the Carrier?

This is the biggest confusion right now. The law says the importer (you) is responsible. But carriers often pay it upfront and then bill you - sometimes with extra fees. Some sellers offer DDP (Delivered Duty Paid) shipping, meaning they cover it. Others say “freight collect,” meaning you pay at delivery. If you’re the buyer, ask the seller: “Do you handle customs duties?” If they say no, assume you’ll pay. Don’t be surprised if your package arrives with a $100 bill from FedEx. That’s now normal.Is It Still Worth It?

Let’s say you need $200/month of insulin. In the U.S., it’s $300. In Canada, it’s $75. Before August 2025, you’d pay $75 + $0 shipping = $75. Now, you pay $75 + $80 duty + $20 shipping = $175. Still cheaper than $300. So yes - it’s worth it. But if you’re buying $30 of vitamins? $30 + $80 duty = $110. That’s not worth it. The new rules make small orders pointless. Only big, necessary meds make sense now.

What If You Can’t Afford the Duty?

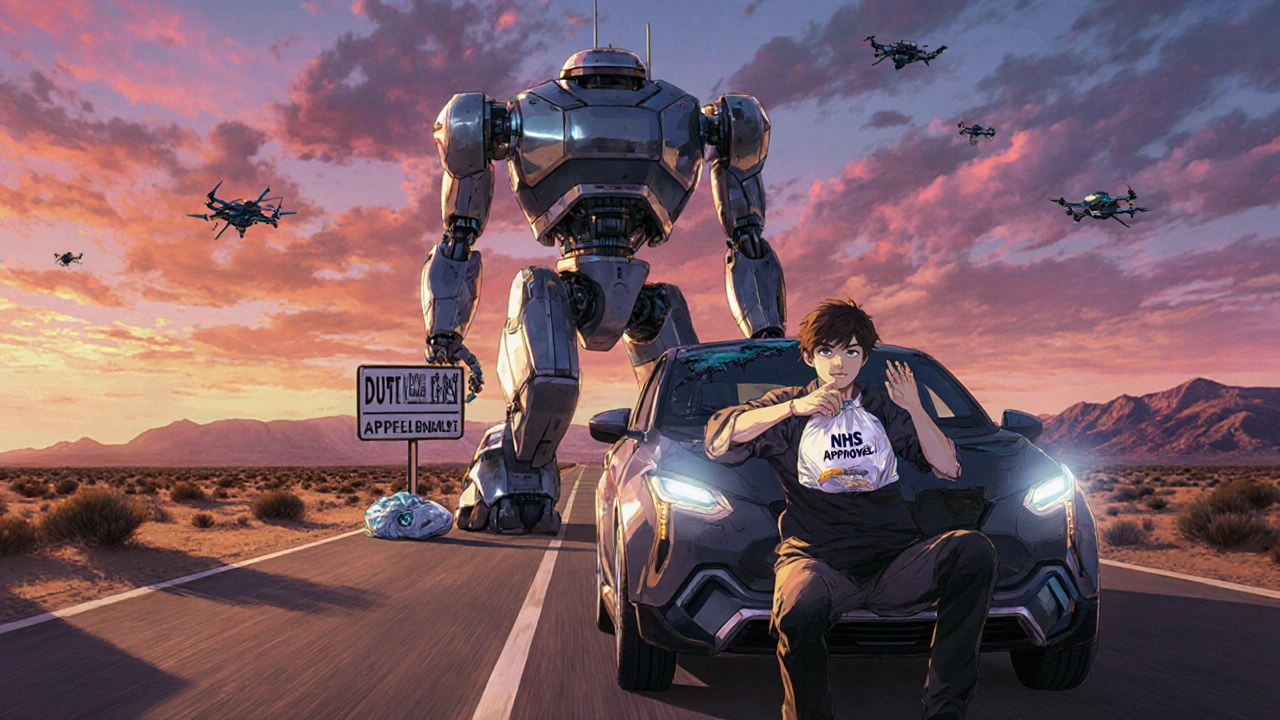

Some people are turning to regional hubs. Buy your meds from Canada or Mexico and have them shipped to a friend in a border town. Then drive across to pick them up. No customs, no fees. It’s legal as long as you’re not reselling. Others are using pharmacy savings programs like GoodRx or RxHope. These can cut U.S. prices by 70%. For some drugs, they’re now cheaper than ordering overseas - even with duty.What Happens If You Get Caught?

If customs catches you with unapproved meds, they can:- Seize the package

- Send you a warning letter

- Impose a fine (rare for personal use)

- Block future shipments

Bottom Line: What You Need to Do Now

If you’re still planning to use international mail-order for medication:- Only buy from verified pharmacies with VIPPS or equivalent licenses

- Order only 3-month supplies or less

- Get a prescription or doctor’s note

- Use DHL, FedEx, or UPS - not USPS

- Fill out a real commercial invoice with HS code and exact value

- Expect to pay $80-$200 in duty per shipment

- Only do it for essential, high-cost meds - not vitamins or supplements

Can I still buy insulin from Canada by mail in 2025?

Yes, but only if you follow the new rules. You must use a licensed Canadian pharmacy, declare the true value on a commercial invoice, include the correct HS code (3004.90), and use a carrier like FedEx or DHL. You’ll pay a $80-$200 duty fee depending on the method used. The FDA allows personal importation of insulin if it’s for your own use and you have a prescription.

Why did the U.S. eliminate the $800 duty-free limit?

The U.S. government says it was to level the playing field for American businesses and collect lost tax revenue. In 2024, over $187 billion in goods entered the U.S. duty-free under the old rule. Much of it came from e-commerce sellers who didn’t pay sales tax or tariffs. The change was also part of a broader trade policy shift to control cross-border e-commerce and protect domestic industries.

Are there any countries I should avoid when ordering medication?

Avoid pharmacies based in China, Russia, Nigeria, and Southeast Asian countries with weak regulatory oversight. These are common sources of counterfeit drugs. In 2024, the WHO estimated that 1 in 10 medical products in low-income countries were fake. Even if a site looks professional, if it doesn’t have a verifiable license, physical address, or contact info, don’t trust it.

What happens if my package is seized by customs?

Your package will be held and you’ll receive a notice from U.S. Customs. You can either pay the owed duties and taxes to release it, or let it be destroyed. If you believe the seizure was wrong (e.g., you declared the correct value), you can file a formal protest with CBP within 180 days. But if you lied about the value or didn’t include required documents, your chances of getting it back are low.

Can I use USPS to send medication overseas?

No. Since September 1, 2025, the U.S. Postal Service no longer accepts commercial shipments of medication to the U.S. from abroad. They only handle personal letters and gifts under $100. For any medication purchase, you must use a private carrier like DHL, FedEx, or UPS that has customs brokerage capabilities.

Is it legal to order medication from Mexico by car instead of mail?

Yes. If you live near the border, you can drive into Mexico, buy your medication at a licensed pharmacy, and bring it back for personal use. You’re allowed to bring in up to a 90-day supply without declaring it, as long as it’s not a controlled substance. This avoids all customs fees and paperwork. Many Americans use this method for insulin, cholesterol meds, and pain relievers.

Emily Entwistle

November 18, 2025 AT 06:54OMG this is such a lifesaver 😭 I’ve been buying my insulin from Canada for years and just panicked when I heard about the new rules. Thanks for breaking it down so clearly! I’ll definitely use FedEx now and stop lying to customs… again. 🙈

deepak kumar

November 19, 2025 AT 00:23As someone who works in pharma logistics in India, I can confirm: if you order from Apollo or MedPlus with a valid script, you’re golden. Just make sure the invoice says 'Metformin 500mg tablets' not 'health supplement'. We’ve had dozens of packages bounced because of lazy labeling. Also, HS code 3004.90 is your best friend. 🙌

Jonathan Gabriel

November 19, 2025 AT 23:40So let me get this straight… the government spent billions to block $800 packages… so now we pay $80 on a $25 pill? 🤔 The real scam is that insulin costs $300 here but $75 overseas… and we’re the ones getting fined for trying to survive. Classic. Also, who decided 'gift' was a valid label for metformin? That’s not a birthday present, it’s my blood sugar’s only friend. 😅

Don Angel

November 20, 2025 AT 09:39Just a heads-up: if you’re using DHL, make sure you check their duty calculator BEFORE shipping. I paid $190 on a $60 order last month… and they charged me $15 extra for 'handling'. No thanks. Always ask for DDP. Also, keep that prescription PDF handy. I printed mine and taped it to the box. Customs actually waved me through. 🤷♂️

kim pu

November 20, 2025 AT 14:41Y’all are so naive. This isn’t about taxes-it’s about Big Pharma buying Congress. The $800 threshold got axed because they wanted you to pay full price. The FDA doesn’t care if you live or die, they care if your pill has a U.S. label. And don’t even get me started on how they’re using HS codes to track your medical history. They’re building a database. Mark my words. 🕵️♀️

Samkelo Bodwana

November 21, 2025 AT 06:16Coming from South Africa, where we’ve been buying meds from India and Thailand for over a decade, this whole thing feels oddly familiar. We’ve always had to navigate gray zones-whether it’s antiretrovirals or diabetes meds. The key is consistency: same pharmacy, same script, same carrier. Don’t switch vendors like you’re shopping on Amazon. And never, ever use 'gift' as a descriptor. Customs officers aren’t stupid-they’ve seen every trick in the book. I’ve shipped over 30 packages in the last year, all cleared without issue, just by being boringly accurate. Name the drug. List the dose. Include the prescription. And for heaven’s sake, don’t try to save $5 by under-declaring. It’s not worth the anxiety.

Also, if you’re thinking of driving to Mexico, do it right. Don’t just buy a month’s supply and drive back. Get a 90-day supply, keep the receipt, and don’t act sketchy at the border. The CBP officer will smell fear. Just smile, say 'personal use', and hand over your script. They’ve seen it a thousand times. It’s not illegal-it’s just paperwork-heavy. And honestly? If you’re spending $200 a month on insulin, $175 with duty is still a win. We’ve paid more for less in our own country. This isn’t smuggling. It’s survival.

And to those saying 'just use GoodRx'-yeah, that works for some drugs. But try getting a 90-day supply of liraglutide for $50 with GoodRx. I dare you. The math doesn’t lie. The system is rigged, but the loopholes? They’re still there. You just have to treat it like a job. File the forms. Save the receipts. Know your HS codes. And don’t let the fear of bureaucracy stop you from breathing.

One last thing: if your package gets seized, don’t panic. Call the local CBP office. Ask for the seizure notice number. File a protest. I did it last June. Took three months. Got my meds back. They didn’t even charge me the duty. Because I had the script. The invoice. The tracking. And I didn’t lie. That’s all they need. Not money. Not drama. Just honesty. And patience.

Sarbjit Singh

November 22, 2025 AT 15:59Bro, I ordered my metformin from Chennai last month-$40 for 90 pills. Paid $80 duty, got it in 10 days. FedEx was chill. Just make sure the invoice says 'Pharmaceuticals - Generic Metformin HCl' and not 'medicine for health'. They hate vague labels. 😊

Sameer Tawde

November 24, 2025 AT 09:58India’s generic meds are world-class. Just pick licensed ones. Avoid shady sites. You’ll save 70%. And yes, duty sucks-but not as much as paying $500/month for insulin. You got this! 💪

malik recoba

November 26, 2025 AT 06:58thanks for this. i was gonna order some blood pressure stuff from mexico but was scared i’d get fined. now i feel way better. gonna use fedex and put my dr’s note right on the box. you’re a real one 🙏

Duncan Prowel

November 26, 2025 AT 11:45While the practical advice offered is largely sound, one must not overlook the legal ambiguity inherent in personal importation under FDA guidelines. The agency’s de facto tolerance of such imports does not constitute legal authorization, and the precedent set by 21 CFR 601.12 remains subject to discretionary enforcement. Furthermore, the harmonization of HS codes across jurisdictions is inconsistent; for instance, while 3004.90 is commonly applied to oral medications, certain formulations may fall under 3004.20 or 3004.30 depending on excipients. A misclassification could trigger a tariff escalation beyond the flat-rate estimates cited. It is therefore imperative that importers consult the USITC’s official Harmonized Tariff Schedule database and retain documentation of their classification rationale.

benedict nwokedi

November 27, 2025 AT 20:47Of course they changed the rules. The same people who let Big Pharma jack up prices now want to punish the poor for trying to survive. And don’t you dare think this is about 'fair trade'-it’s about control. They don’t want you to know you can get insulin for $75. They want you begging at CVS with a credit card. The 'gift' loophole? Gone. The 'personal use' loophole? Still there-but they’re watching. They’re tracking your IP. Your shipping address. Your prescription history. And next? They’ll ban international pharmacies entirely. This isn’t policy. It’s a war on the sick. And you? You’re the collateral damage.

Dave Pritchard

November 28, 2025 AT 08:57Hey everyone-just wanted to say thank you for sharing your experiences. I’ve got a friend on insulin who’s been terrified to order anything overseas since the new rules. I’m going to print this out and walk her through it. You’re not just giving advice-you’re helping people stay alive. That matters more than any tariff.

Angela J

November 30, 2025 AT 02:13Wait… so if I order from India and pay the $80 duty… are they still putting tracking chips in the pills? I heard on a podcast that the FDA embeds microchips in all imported meds to monitor your body’s response. I didn’t want to say anything before but… I think my anxiety got worse after my last shipment. Is it the pills… or the chip?? 🤯

Bruce Bain

November 30, 2025 AT 07:45Just keep it simple: buy from Canada. Use FedEx. Put the script in the box. Pay the $80. It’s not fun, but it works. I’ve done it 4 times. No problems. No drama. Just pills. And I’m alive. That’s all that matters.