When a new drug hits the market, it doesn’t just come with a price tag-it comes with a legal shield. Two types of protection keep generics off shelves: patent exclusivity and market exclusivity. They sound similar, but they’re not the same. One comes from the patent office. The other comes from the FDA. And mixing them up can cost companies millions-or make or break a patient’s access to affordable medicine.

Patent Exclusivity: The Legal Right to Block Copies

Patents are issued by the U.S. Patent and Trademark Office (USPTO). If you invent something new-a drug, a device, a process-you can file for a patent. For pharmaceuticals, the most valuable patent is the composition of matter patent. It protects the actual chemical structure of the drug. If you hold this, no one else can make the same molecule, even if they figure it out on their own.

Patents last 20 years from the filing date. But here’s the catch: most drugs take 10 to 15 years just to get approved by the FDA. That means by the time a drug hits shelves, you might only have 5 to 10 years of real market protection left. To make up for lost time, the law lets companies apply for Patent Term Extension (PTE). This can add up to 5 extra years, but the total time after FDA approval can’t go beyond 14 years. So if a drug got approved in 2020 and got a 5-year extension, its patent would expire in 2029-not 2040.

But patents aren’t automatic shields. You have to sue anyone who copies you. If a generic maker says, “Our version is different,” and the court agrees, your patent is useless. That’s why big drug companies often pile on secondary patents-on delivery methods, dosages, or uses. In 2022, 68% of patents listed in the FDA’s Orange Book were secondary, not core chemical patents. These can delay generics, but they’re easier to challenge in court.

Market Exclusivity: The FDA’s Silent Gatekeeper

Market exclusivity doesn’t care if your drug is novel. It cares if you did the work. When you submit clinical trial data to the FDA to get approval, that data is yours. The FDA won’t let anyone else use it to get their own drug approved. That’s the core of market exclusivity.

Unlike patents, market exclusivity is enforced by the FDA itself. No lawsuits needed. If you file for a generic version and your application relies on the innovator’s data, the FDA will reject it-period. This protection starts the day your drug is approved, not when you file your patent.

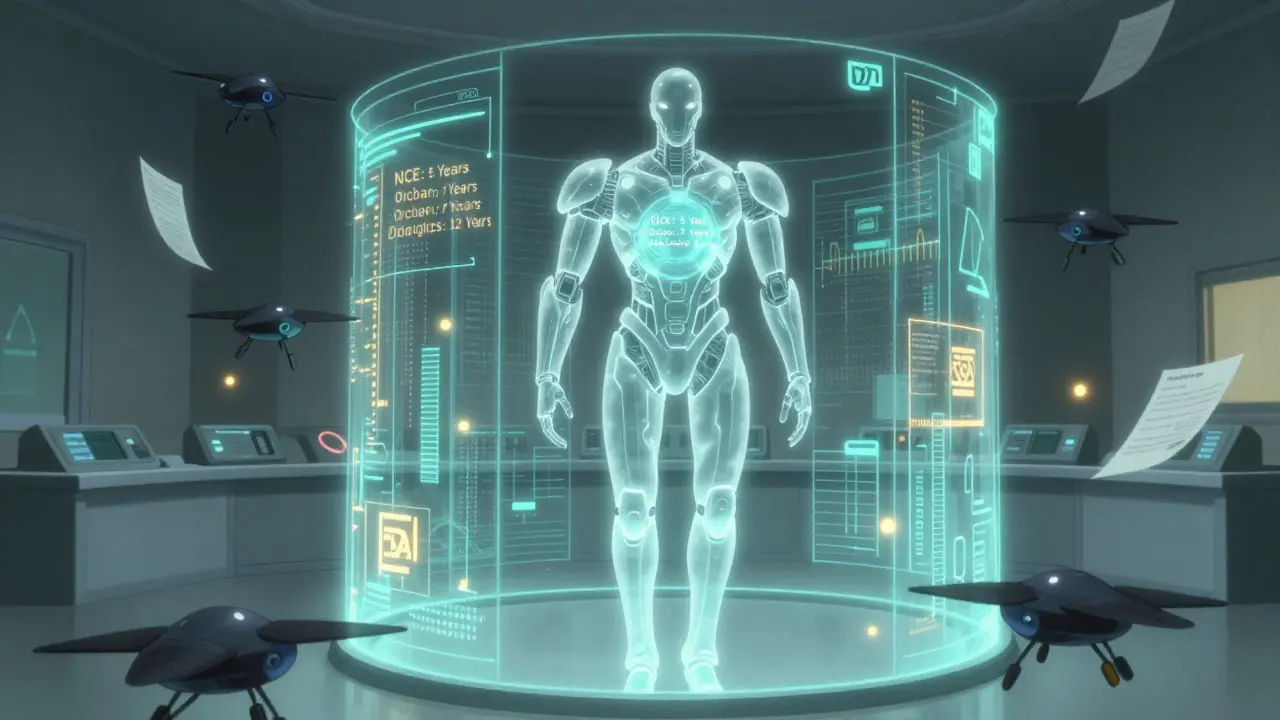

There are different types:

- New Chemical Entity (NCE): 5 years of exclusivity. No generic can even apply during this time.

- Orphan Drug: 7 years for drugs treating rare diseases (fewer than 200,000 patients in the U.S.). Even if there’s no patent, this blocks competitors.

- Pediatric Exclusivity: 6 extra months added to any existing patent or exclusivity period if you test the drug on children.

- Biologics: 12 years of exclusivity under the BPCIA of 2009. This is separate from patents and applies to complex drugs made from living cells, like Humira or Enbrel.

- First Generic Challenge: If a generic company successfully sues to knock out a patent, they get 180 days of exclusive rights to sell the first generic version.

Here’s the kicker: market exclusivity can exist even when there’s no patent. Take colchicine. It’s been used since ancient Egypt. But in 2010, Mutual Pharmaceutical got 10 years of exclusivity after submitting new clinical data. The price jumped from 10 cents to $5 per tablet. No patent. Just exclusivity.

How They Work Together (and Sometimes Against Each Other)

Patents and market exclusivity can run at the same time. Or one can end while the other keeps going. That’s why some drugs stay expensive long after patents expire.

According to FDA data from 2021:

- 27.8% of branded drugs had both patent and exclusivity

- 38.4% had only patents

- 5.2% had only exclusivity

- 28.6% had neither

That 5.2%? Those are the drugs with no patent protection but still no generics. Why? Because the FDA won’t approve copies until the exclusivity period ends. And in 2021, 78% of those drugs still had no generic competition during their exclusivity window.

For example, Trintellix, an antidepressant, lost its key patent in 2021. But because it had 3 years of NCE exclusivity, generics couldn’t enter until 2024. Teva Pharmaceuticals lost an estimated $320 million waiting.

Small biotech firms often rely on exclusivity more than patents. In a 2022 survey, 73% of small companies said they depended on regulatory exclusivity for their main product, especially for reformulated or follow-on drugs. Why? Because patents are expensive to get and easy to challenge. Exclusivity? You just need to run the trials and file the paperwork.

Why This Matters for Patients and Prices

Drug prices don’t drop because a patent expires. They drop when generics enter. And exclusivity delays that entry.

The average cost to develop a new drug is $2.3 billion. Most of that-31%-goes to clinical trials. Companies need exclusivity to recoup that. But when exclusivity lasts too long, patients pay the price.

Between 2018 and 2022, 22% of drugmakers didn’t even claim all the exclusivity they were entitled to. That’s over $1.3 million in lost protection per drug on average. But when companies do claim it, the financial upside is huge. The 6-month pediatric exclusivity extension has generated $15 billion in extra revenue since 1997. The 180-day first-generic window? Worth $100 million to $500 million per drug.

And it’s getting worse. In 2020, regulatory exclusivity accounted for 41% of total market protection time. By 2027, McKinsey predicts it’ll be 52%. Why? Because patents are getting weaker. Courts are striking down secondary patents. So companies are betting more on exclusivity.

What’s Changing in 2025 and Beyond

The FDA launched its Exclusivity Dashboard in September 2023. Now anyone can see exactly when each drug’s exclusivity ends. That’s good for generics-they can plan ahead. But it’s also a warning to innovators: hiding exclusivity won’t work anymore.

The PREVAIL Act of 2023 is trying to cut biologics exclusivity from 12 to 10 years. If it passes, it’ll be the biggest shift in drug protection since Hatch-Waxman. And it’s not just the U.S. The World Trade Organization is debating whether to waive exclusivity for other medicines, like cancer drugs, the same way it did for COVID vaccines.

Meanwhile, the FDA is requiring more detailed justifications for exclusivity claims starting January 1, 2024. No more vague filings. If you want exclusivity, you’ll have to prove your data was truly new and necessary.

What You Need to Know

If you’re a patient: Don’t assume a drug becomes cheaper when its patent expires. Check if it still has exclusivity. The FDA’s Drugs@FDA database shows both.

If you’re a generic manufacturer: Look for drugs with expired patents but active exclusivity. That’s your target. But don’t waste money on a legal challenge if the exclusivity clock is still ticking.

If you’re a biotech startup: Don’t rely on patents alone. File for exclusivity. It’s cheaper, harder to challenge, and often lasts longer.

The system was meant to balance innovation and access. But today, it’s tilted. Exclusivity is becoming the new patent. And the real question isn’t whether a drug is patented-it’s whether the FDA will let anyone else sell it.

Do patents and market exclusivity always expire at the same time?

No. Patents expire based on their filing date (usually 20 years), while market exclusivity starts when the FDA approves the drug. A drug can have 12 years of exclusivity but only 5 years of patent life left. Or it can have no patent at all and still be protected by 5 years of exclusivity. They operate on separate clocks.

Can a drug have exclusivity without a patent?

Yes. This happens often. The colchicine case is the most famous example. A drug made from a 3,000-year-old remedy got 10 years of exclusivity because the company submitted new clinical data. The FDA doesn’t require novelty-it just needs new studies proving safety and effectiveness for a new use or formulation.

Why do generic companies wait so long to enter the market?

They wait because the FDA won’t approve them until exclusivity ends-even if the patent is gone. Generic manufacturers often file applications right before exclusivity expires, but if they submit data that relies on the innovator’s studies, the FDA will reject it. That’s why some generics wait years, even after patent expiration.

What’s the difference between data exclusivity and market exclusivity?

Data exclusivity means the FDA won’t use your clinical trial data to approve a competitor. Market exclusivity means the FDA won’t approve the competitor’s drug at all. In the U.S., NCE exclusivity gives you both. In the EU, they’re split: 8 years data protection, then 2 more years market protection, then 1 extra year for new uses.

Can I find out when a drug’s exclusivity ends?

Yes. The FDA’s Exclusivity Dashboard, launched in September 2023, shows real-time expiration dates for all regulatory exclusivities. You can search by drug name and see exactly when generics can enter. It’s free and publicly available.

What’s Next for Drug Pricing?

As patents weaken, exclusivity is becoming the main tool to delay generics. That’s why Congress is looking at reforms. But until then, the system stays complex. The key is understanding that a patent expiration doesn’t mean lower prices. The FDA’s clock is the real timer.

If you’re watching drug costs, don’t just track patents. Track exclusivity. That’s where the real battle is now.

Joie Cregin

January 16, 2026 AT 17:18Wow, this broke down something so complex into something I actually get. I never realized that a drug could be stuck at $5 a pill just because some company did a few new trials on a 3000-year-old remedy. That’s wild. 🌿

Melodie Lesesne

January 17, 2026 AT 12:42So basically the FDA is the real gatekeeper now, not the patent office? That’s kinda scary but also makes sense. I’ve seen too many people assume ‘patent expired = cheap drug’ and then get mad when it’s not. This clears it up.

Corey Sawchuk

January 19, 2026 AT 05:09Patents are for inventors, exclusivity is for the ones who did the legwork. That’s the core of it. The system’s messy but it’s not broken - just weighted. And yeah, colchicine is a perfect example of how the rules can be gamed.

Stephen Tulloch

January 19, 2026 AT 13:52LMAO the ‘biotech startups don’t rely on patents’ thing is such a flex. Big pharma’s been whispering ‘regulatory exclusivity’ like it’s a secret spell since 2010 😂. 12 years for biologics? Bro, that’s not innovation, that’s a monopoly with a lab coat. 🧪💸

Henry Ip

January 21, 2026 AT 02:49Great breakdown. I’ve been telling my patients for years: don’t assume price drops at patent expiry. The FDA’s clock is the real one. The Exclusivity Dashboard is a game-changer - bookmark it. 🙌

Kasey Summerer

January 22, 2026 AT 14:14So the U.S. is basically saying ‘you did the work, you get to charge $5000 for a pill for 12 years’ while other countries are like ‘nah, let’s just make it affordable.’ And we wonder why people fly to Canada for meds 😏

Cheryl Griffith

January 23, 2026 AT 19:36I have a friend with rheumatoid arthritis who’s been on Humira for 10 years. She cried when she found out generics wouldn’t be available until 2026 - even though the patent expired in 2019. This isn’t just policy. It’s people’s lives. We need to fix this.

brooke wright

January 25, 2026 AT 13:55Wait so if a company just tweaks a drug’s coating or dosage they get another 6 months? That’s not innovation that’s cheating. The FDA should stop letting them do this. It’s like buying a car and then charging extra because you put new seat covers on it.

Nick Cole

January 27, 2026 AT 00:57Exactly. Pediatric exclusivity is the most abused loophole. Companies run one tiny study on kids just to tack on 6 months. They don’t even care if it helps kids - they just want the clock to keep ticking. This system is rigged.

Isabella Reid

January 27, 2026 AT 01:46It’s funny how we praise innovation but then let companies extend monopolies with paperwork tricks. The real innovation should be in access - not in legal loopholes. Maybe we need a ‘usefulness test’ for exclusivity, not just a ‘data submitted’ checkbox.

Ryan Hutchison

January 27, 2026 AT 14:38Why are we even talking about this? America invented modern pharma. We pay more because we fund the R&D. If you want cheap drugs, go to India. Stop whining about patents. We built this.

evelyn wellding

January 29, 2026 AT 14:15Y’all need to check out the FDA dashboard!! It’s free and so easy to use. I’m a nurse and I show it to my patients all the time. Knowledge is power 💪❤️

Chelsea Harton

January 30, 2026 AT 17:59patents are dead long live exclusivity the real monopoly is in the fda’s hands now