When you pick up a prescription for metformin, lisinopril, or atorvastatin, you might assume the price is fixed - but it’s not. In fact, the cost of these generic drugs can vary by more than 300% between pharmacies. This isn’t a glitch. It’s the result of a hidden market battle called a generic price war.

What Exactly Is a Generic Price War?

A generic price war happens when multiple companies start making the same off-patent drug. Once a brand-name drug’s patent expires, any manufacturer can apply to produce a generic version. These generics have the same active ingredients, same effectiveness, and same safety profile - but they cost a fraction of the original. The more companies that enter the market, the harder they compete to win business. That competition drives prices down - sometimes dramatically. The FDA found that when six or more manufacturers make the same generic drug, prices drop by more than 95% compared to the brand-name version. That’s not a guess. It’s data from real-world sales. A drug that once cost $300 a month might drop to $10 - or even less. But here’s the catch: you don’t always see those savings at the pharmacy counter.Why You’re Not Always Saving

You’d think lower drug costs mean lower bills for patients. But the system is stacked with middlemen. Pharmacy Benefit Managers (PBMs) control most of the negotiations between drug makers, insurers, and pharmacies. They don’t work for you. They work for insurance companies and big pharmacy chains. PBMs use a trick called spread pricing. They tell your insurer you paid $20 for your generic pill. But they only paid the pharmacy $5. The $15 difference? That’s their profit. Your copay stays the same, even though the drug cost dropped by 90%. In some cases, your insurance copay is actually higher than the cash price. A 2022 study from the USC Schaeffer Center found that in 28% of cases, the cash price for a generic was lower than the insurance copay. But most people don’t know this. Pharmacists used to be legally blocked from telling you - thanks to "gag clauses" - until the 2018 Know the Lowest Price Act banned them. Still, many don’t volunteer the information.How Competition Drives Prices Down

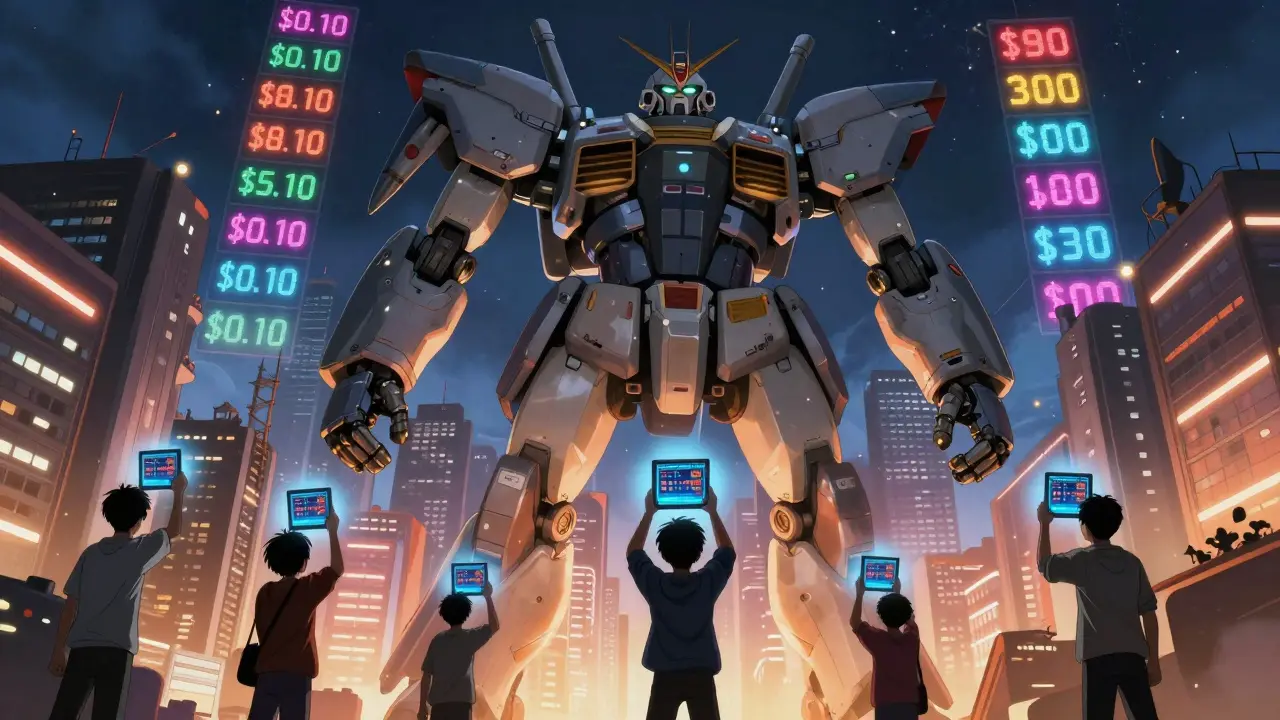

The number of generic manufacturers directly controls the price. Here’s what the data shows:- One generic maker? Price is about 15-30% lower than brand.

- Two generic makers? Price drops to 44-54% below brand.

- Four generic makers? Price falls 73-79% below brand.

- Six or more makers? Price drops over 95%.

Who Controls the Market?

Five companies - Teva, Viatris, Sandoz, Amneal, and Aurobindo - control over 60% of the U.S. generic drug market. That’s not competition. That’s an oligopoly. When only a few players dominate, they can coordinate pricing quietly. They don’t need to slash prices if they’re already sharing the pie. A 2023 Harvard Law review pointed out that this concentration undermines true competition. Even when multiple generics are available, price drops aren’t always passed on. Some drugs with three or four makers still cost nearly as much as the brand because no one wants to be the first to cut prices.How to Actually Save Money

You can’t control the market. But you can control what you pay at the counter. Here’s how:- Always ask for the cash price. Don’t assume your insurance copay is the lowest option. Many generics cost less out-of-pocket than your insurance plan allows.

- Use price comparison tools. GoodRx, SingleCare, and Amazon Pharmacy show real-time prices across hundreds of pharmacies. A pill that costs $25 at Walgreens might be $8 at Walmart.

- Check for manufacturer discounts. Some companies offer free or low-cost generics to people without insurance. Look up the drug name + "patient assistance program".

- Stick with the same pharmacy. Some chains offer loyalty programs for chronic meds. Walmart, Kroger, and Costco have $4 generic lists for dozens of common drugs.

- Know your drug’s AB rating. The FDA assigns AB codes to show bioequivalence. If it says AB, it’s as good as the brand. Avoid generics with no code - they may not be approved.

Solomon Ahonsi

February 2, 2026 AT 21:59Why the hell are we still paying $20 for a pill that costs 50 cents to make? This system is rigged from top to bottom. I don’t care how many ‘generic’ labels they slap on it - if I have to dig through five apps just to not get robbed at the pharmacy, something’s broken. And no, I’m not signing up for another ‘patient assistance program’ - I work full time.

George Firican

February 4, 2026 AT 14:03The tragedy here isn’t just the greed of PBMs or the oligopoly of generic manufacturers - it’s the quiet normalization of healthcare as a commodity. We’ve accepted that essential medicine should be a gamble of price transparency, that our health is subject to the whims of corporate arbitrage. The fact that a life-sustaining drug can fluctuate in price like a cryptocurrency is not innovation - it’s systemic failure dressed in the suit of capitalism.

And yet, we’re told to ‘shop around’ like we’re comparing laundry detergent. The burden is placed on the sick, the elderly, the underinsured - not on the institutions that engineered this chaos. The real question isn’t how to save money - it’s why we’re forced to play this game at all.

Matt W

February 5, 2026 AT 09:41I used to just let my insurance handle everything until I found out my $15 copay for metformin was actually $4 cash at CVS. I felt like an idiot. Now I check GoodRx before I even walk in. It’s not just savings - it’s sanity. Also, Walmart’s $4 list is a godsend for my dad’s meds. No hype, just real help.

Anthony Massirman

February 5, 2026 AT 20:53Just ask for the cash price. Done.

Brett MacDonald

February 7, 2026 AT 16:29so like… if more companies make the drug… why does it cost more? i thought more supply = lower price? but then u said when there’s 6+ makers the price drops… so what gives? is this some kind of fake economy? i’m confused lol

phara don

February 9, 2026 AT 05:17Man, I had no idea about the gag clauses. I remember asking my pharmacist once why my copay was higher than the cash price and they just looked at me like I asked for the moon. Now I get it - they were legally silenced. That’s wild. And now I check GoodRx religiously. My insulin bill dropped by 70%. 🙏

Murarikar Satishwar

February 10, 2026 AT 00:13Excellent breakdown. The data on manufacturer count versus price reduction is particularly compelling. It is not merely anecdotal - it is empirically verifiable that competition drives down prices in a predictable, quantifiable manner. Furthermore, the concentration of market power among five firms undermines the very premise of a free market. This is not capitalism - it is rent-seeking disguised as market dynamics. Patients must be empowered with transparent pricing mechanisms, and regulatory intervention must prioritize consumer welfare over corporate margins.

Bob Hynes

February 11, 2026 AT 15:12bro this is wild. i thought generics were supposed to be the people’s medicine. instead we got a corporate maze where the only winner is the middleman who never even touched the pill. i just found out my $30 lisinopril was $6 at Costco. i cried a little. not because i’m sad - because i wasted 3 years paying more than i had to. we need to tell everyone. like, right now.

Nick Flake

February 12, 2026 AT 02:24This is one of those topics where the solution is stupidly simple - but the system is designed to make you feel stupid for not knowing it. 🌱

Ask for cash price. Use GoodRx. Stick to Walmart or Costco. It’s not magic. It’s just not being played by the rules they wrote for you.

And yeah - if you’re on 5 meds? $600/year is life-changing money. That’s a vacation. A new pair of shoes. A month’s rent.

We’re not asking for revolution. Just basic fairness.

Akhona Myeki

February 13, 2026 AT 14:15As a South African citizen who has witnessed state-run pharmaceutical distribution in a resource-constrained environment, I find it morally reprehensible that a nation with the technological and economic capacity of the United States permits such predatory pricing mechanisms to persist. The systemic failure you describe is not merely economic - it is a violation of the fundamental human right to health. The absence of universal healthcare is not an oversight - it is a policy choice. And it is indefensible.

Vatsal Srivastava

February 13, 2026 AT 20:53Everyone’s acting like this is news. The generic market has been a cartel since 2010. The FDA approves 1000 generics? Big deal. Most are just rebranded versions from the same 5 companies. You think Walmart’s $4 list is charity? Nah. They use it as a loss leader to get you in the door for overpriced snacks and toilet paper. You’re still being played.