Not all generic drugs are created equal. While you might think a generic version of a brand-name medicine is just a cheaper copy, that’s not always true. For simple pills like generic ibuprofen or metformin, the path to approval is straightforward. But when it comes to complex generic drugs, the story changes completely. These aren’t just reformulations-they’re scientifically intricate products that can take years longer to approve, cost millions more to develop, and often never make it to market at all.

What Makes a Generic Drug "Complex"?

A complex generic drug isn’t just a tablet with a different logo. It’s a product with ingredients or delivery systems so intricate that standard testing methods don’t work. The FDA defines these as drugs with:

- Complex active ingredients-like peptides, proteins, or large polymer molecules

- Advanced delivery systems-such as liposomes, nanoparticles, or long-acting injectables

- Drug-device combinations-like inhalers, auto-injectors, or patches that must work perfectly every time

- Specialized routes of administration-think intramuscular, intrathecal, or inhaled formulations

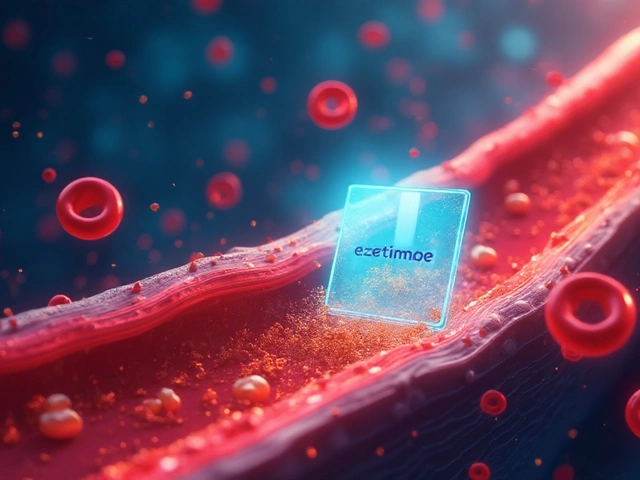

Take bupivacaine liposome injectable, for example. This is a painkiller trapped inside tiny fat bubbles (liposomes) that slowly release the drug over days. To prove a generic version works the same way, regulators can’t just measure blood levels like they do for a regular pill. They need to track how the drug moves through tissue, how long it lasts, and whether the liposomes behave identically to the original. That’s not just hard-it’s groundbreaking science.

Why the FDA Struggles to Approve Them

The FDA’s standard approval path for generics is the Abbreviated New Drug Application, or ANDA. It’s called "abbreviated" because it doesn’t require new clinical trials. For simple generics, this works fine: show the active ingredient is the same, prove it dissolves the same way, and demonstrate it gets into the bloodstream at the same rate. Done.

But for complex generics, that model breaks down. You can’t just compare blood levels if the drug doesn’t enter the bloodstream the same way. A liposomal injectable might sit in muscle tissue for weeks, slowly leaking out. A complex inhaler might deliver the same dose, but if the nozzle shape is off by 0.1 millimeters, the lung deposition could be completely different. And that’s not a small detail-it’s a dealbreaker.

That’s why the FDA created the Pre-ANDA Meeting Program under GDUFA II in 2017. It lets manufacturers meet with regulators before submitting an application to figure out what data they need. By 2023, over 1,200 of these meetings had been held. Still, many companies walk away frustrated. One manufacturer told regulators, "We spent $30 million and two years building a test method, only to be told it wasn’t good enough. No one told us what "good enough" looked like."

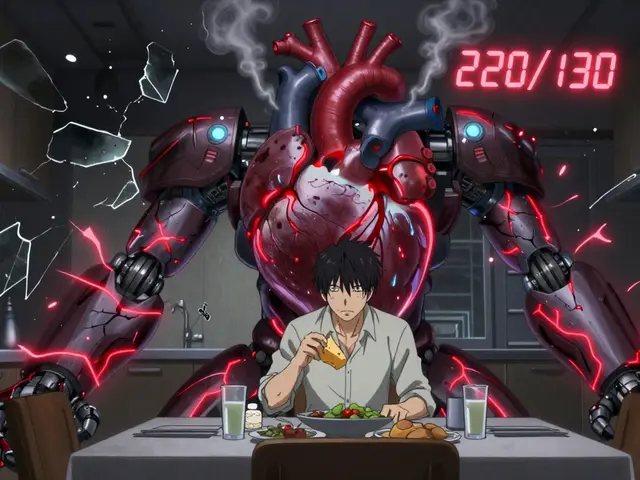

The Data Doesn’t Lie

Between 2015 and 2023, the FDA approved over 1,000 conventional generic drugs. During the same period, it approved just 15 complex generics. That’s not a typo. Fifteen.

Why such a gap? Because the science is harder, the tests are unproven, and the regulatory bar keeps shifting. A 2021 systematic review of 24 global studies found that the top challenges were:

- Analytical challenges (19 studies)-How do you even measure something this complex?

- Regulatory challenges (21 studies)-What data does the FDA actually want?

- Formulation challenges (17 studies)-Can you replicate the exact particle size, viscosity, or release profile?

And it’s not just the FDA. In China, you need a local agent and must run local trials. In Brazil, every lab and clinical site must be certified under ICH guidelines. That adds months, sometimes years, to development.

Cost and Time: The Hidden Barriers

Developing a simple generic can cost $1-$5 million and take 2-3 years. A complex generic? $20-$50 million and 5-7 years. And there’s no guarantee of approval.

That’s why only a handful of companies even try. Big pharma has moved on. Smaller generics firms can’t afford the risk. The few that do often file a 505(b)(2) application instead of an ANDA. That’s a hybrid route that requires some new data-so it’s not truly a generic anymore. It’s a "follow-on" product, and it costs more. Patients end up paying more, too.

Why This Matters to Patients

Complex generics aren’t niche. They treat serious conditions: chronic pain, cancer, asthma, multiple sclerosis, and rare diseases. When a branded drug like a long-acting insulin or a chemotherapy inhaler loses patent protection, patients expect cheaper options. But if no generic can get approved, those drugs stay expensive for years.

Take inhalers. A branded asthma inhaler might cost $500. A simple generic version? $100. But if the inhaler is complex-say, it uses a unique propellant and valve system-there might be no generic at all. Patients keep paying the high price. Or worse, they skip doses because they can’t afford it.

The FDA admits this is a problem. In its FY 2025 plan, it pledged to develop "more efficient approaches for bioequivalence" for complex products. But progress is slow. The agency has published over 160 product-specific guidances since 2019 to help companies, but many still feel like they’re guessing.

What’s Changing? The Tools of the Future

Hope is coming-not from regulation, but from science. Companies are now using:

- Machine learning to predict how a drug will behave in the body

- Artificial intelligence to analyze thousands of data points from analytical tests

- Quality-by-design (QbD) frameworks that build consistency into the manufacturing process from day one

- Orthogonal testing-using multiple, independent methods to confirm results

One study showed AI could reduce development time by up to 30%. QbD approaches could cut FDA review cycles by nearly half. But these tools aren’t magic. They require expertise, investment, and time. And not every company has them.

The Road Ahead

Complex generics are the next frontier in affordable medicine. They represent a $75 billion market opportunity as branded drugs lose patent protection. By 2028, they could make up 25% of the global generics market.

But unless the FDA, manufacturers, and regulators worldwide align on clear, science-based standards, that potential will stay locked away. The system isn’t broken-it’s outdated. The same rules that worked for aspirin don’t work for liposomal cancer drugs.

Patients deserve better. Doctors need alternatives. And insurers want lower costs. The only way forward is to treat complex generics like what they are: not simple copies, but sophisticated medical products that deserve a smarter, more flexible approval path.

Katherine Carlock

January 13, 2026 AT 07:11Wow this is wild. I had no idea generics could be this complicated. I always thought it was just about saving money, but now I see it’s like trying to copy a rocket engine by only looking at the outside.

Sona Chandra

January 13, 2026 AT 23:52This is why America is falling behind. We let Big Pharma hold the keys to life-saving drugs and then act shocked when generics don’t magically appear. Fix the system or stop pretending you care about patients.

Jennifer Phelps

January 15, 2026 AT 16:04So if you can’t measure blood levels how do you even prove it works is it just guesswork or do they use some kind of simulation or what

beth cordell

January 16, 2026 AT 00:45😭 This is why my mom skips her inhaler doses. She can’t afford the $500 one and the generic doesn’t exist. We need change not more meetings.

Lauren Warner

January 17, 2026 AT 17:34The FDA’s 160 guidances are just bureaucratic theater. If they wanted to fix this they’d mandate standardized testing protocols not publish more PDFs no one reads. This is regulatory theater at its finest.

Craig Wright

January 19, 2026 AT 02:20It is entirely unacceptable that the United States permits such regulatory inefficiency. In the United Kingdom we have a clear and rigorous system. The NHS ensures access to generics without such delays. This American chaos is a disgrace.

Lelia Battle

January 20, 2026 AT 05:43It’s fascinating how the same regulatory framework that worked for aspirin in the 1950s is still being stretched to cover liposomal nanoparticles in 2025. Maybe we need to stop treating all drugs like pills in a bottle.

Rinky Tandon

January 20, 2026 AT 11:25Of course the FDA is clueless. They don’t even understand basic chemistry. India has been making complex generics for a decade. We have the labs the tech the talent. Why are we letting Americans hold up global access with their red tape

Ben Kono

January 21, 2026 AT 18:16So if it costs 50 million to make one generic why does anyone even try

Cassie Widders

January 23, 2026 AT 16:50I read this while waiting for my insulin refill. It’s not just science. It’s people skipping doses because they can’t pay. That’s the real number behind those 15 approvals.

Konika Choudhury

January 25, 2026 AT 10:37Why are we even talking about this when India can make these cheaper and better we have the factories the engineers the willpower

Darryl Perry

January 26, 2026 AT 18:30Cost is the problem. If it’s too expensive to make it won’t be made. Simple.

Prachi Chauhan

January 28, 2026 AT 10:20It’s like trying to recreate a symphony by only copying the sheet music but not the orchestra. The liposomes the valves the delivery systems - they’re not just ingredients. They’re the musicians. If you replace one violin with a kazoo the whole thing falls apart. We treat drugs like Lego blocks but they’re living systems. The FDA isn’t broken. We’re just using the wrong tools to understand them.

Windie Wilson

January 29, 2026 AT 21:53So the FDA has 160 guidances but still no clue how to approve a liposome? 😂 Maybe they should just hire a TikTok chemist.